Leading Manufacturers of Best Gas Turbines for Global Exports

In the dynamic landscape of global energy production, gas turbines have emerged as a pivotal technology driving efficiency and sustainability. According to a report from the International Energy Agency (IEA), gas turbines accounted for approximately 54% of the total global power generation in 2022, underscoring their significance in the transition towards cleaner energy systems. As the demand for electric power continues to rise, leading manufacturers are innovating and expanding their capabilities to meet international market needs. The projected growth of the gas turbine market, estimated to reach USD 37.98 billion by 2028, indicates a robust industrial landscape, where advancements in design and technology are critical. This blog explores the leading manufacturers of gas turbines, shedding light on their contributions to global exports and the broader implications for the energy sector.

Top Gas Turbine Manufacturers Dominating Global Markets

The global market for gas turbines is witnessing significant growth, with projections indicating an increase at a CAGR of 4.20% by 2033. In 2025, the market was valued at approximately $14.68 billion, and it's expected to expand further as industries seek cleaner and more efficient energy solutions. Leading manufacturers are strategically positioning themselves to dominate the market, leveraging advancements in technology and production capabilities to meet rising global demand.

Tips for maximizing performance in gas turbine operations include regular maintenance checks to ensure optimal efficiency and updating software to enhance predictive analytics capabilities. Additionally, exploring hybrid solutions, combining gas turbines with renewable energy sources, can yield overall cost savings and improved sustainability metrics.

As China's influence in renewable energy grows, particularly in wind and solar power installations, it's crucial for manufacturers worldwide to adapt to new technologies. The shift in focus towards greener alternatives not only aligns with global sustainability goals but also offers lucrative opportunities in regions previously reliant on coal and fossil fuels for energy generation. Investing in innovative designs and smart turbine technologies will be key to capturing market share in this ever-evolving landscape.

Key Innovations in Gas Turbine Technology by Leading Firms

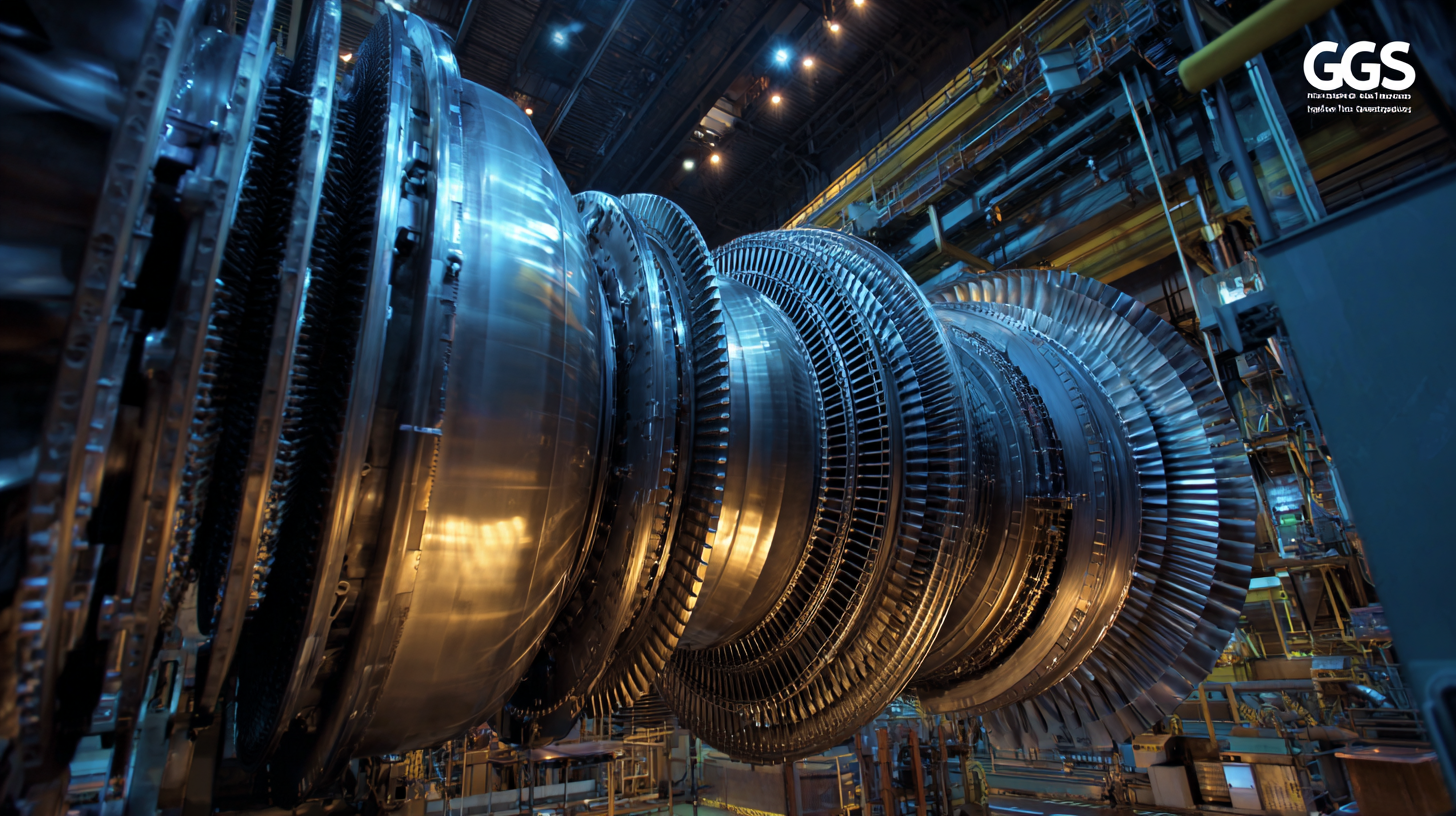

In recent years, the gas turbine industry has witnessed significant innovations led by top manufacturers, positioning them strategically for global exports. These advancements are not only enhancing efficiency but also focusing on sustainability, catering to growing environmental concerns. Firms like General Electric, Siemens, and Mitsubishi Power are at the forefront, developing advanced materials and designs that allow for higher temperatures and pressures, resulting in improved thermodynamic performance and reduced emissions.

Key innovations include the integration of digital technologies such as predictive analytics and IoT for real-time monitoring and maintenance, optimizing operational efficiency. Additionally, advancements in aerodynamics and combustion technology have enabled turbines to operate on a wider range of fuels, including renewable sources. These manufacturers are also investing in hybrid solutions that combine gas turbines with renewable energy systems, ensuring a more resilient and flexible energy landscape. Such innovations not only enhance the competitiveness of these leading firms in the global market but also underline their commitment to a cleaner energy future.

Comparative Analysis of Gas Turbines for Different Industry Applications

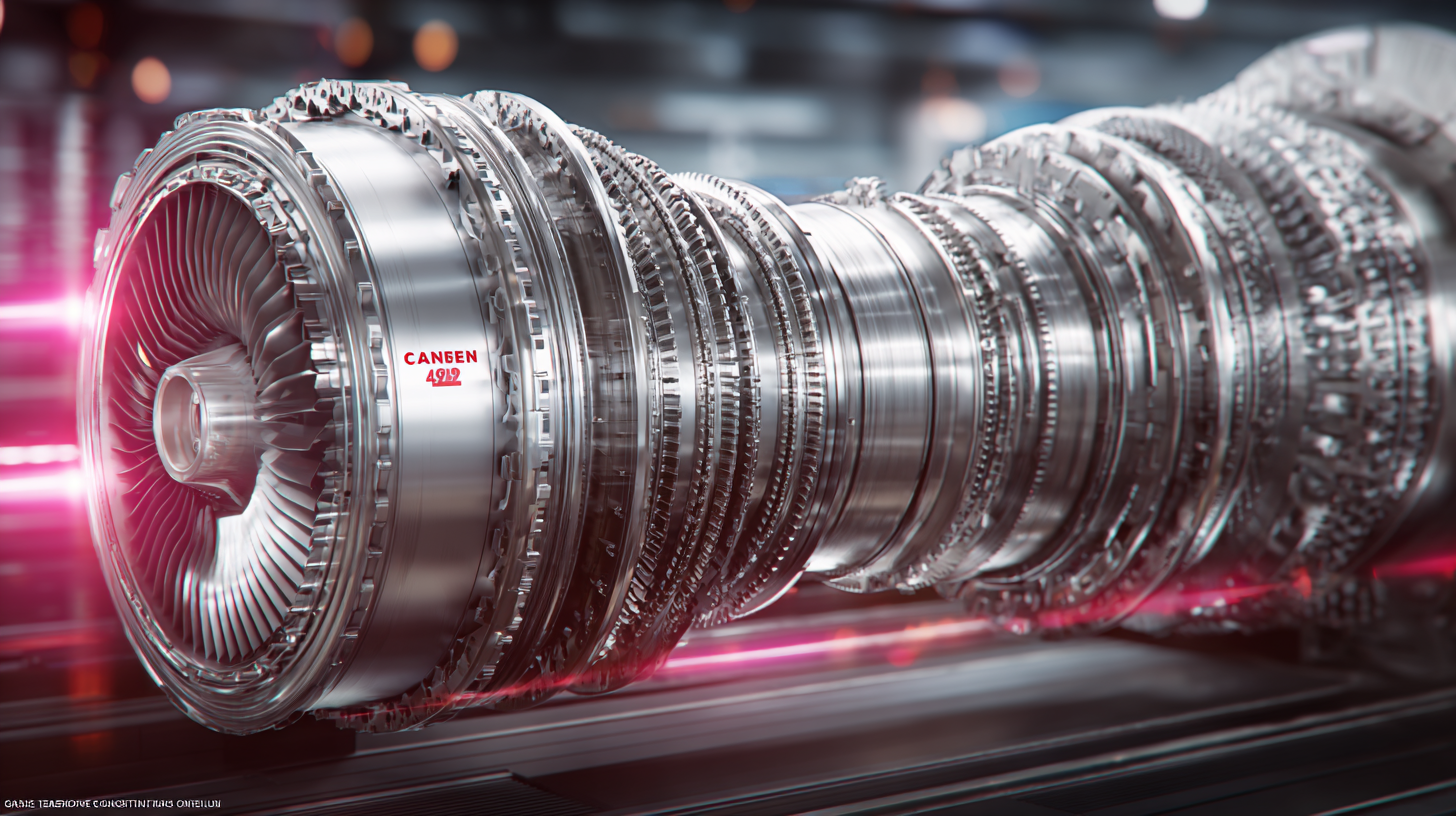

In the world of industrial applications, gas turbines have emerged as a crucial technology, catering to various sectors including power generation, aviation, and marine propulsion. Each industry has unique requirements that dictate the choice of turbine specifications. For instance, power generation turbines are designed for high efficiency and reliability, while aviation turbines prioritize lightweight and compact design. Understanding these differences is key for manufacturers targeting global exports.

When selecting a gas turbine for a specific application, consider the operational environment and fuel type. Turbines used in colder climates may require robust materials to withstand harsh conditions, while those operating in hotter areas must focus on cooling technologies. Additionally, efficiency ratings and maintenance needs should heavily influence the decision-making process.

Tips: Always consult with industry experts to align your turbine choice with the specific operational challenges of your sector. Regular training and updates on turbine technology can enhance operational efficiency. Lastly, evaluating potential suppliers based on their customer support and service capabilities can ensure long-term reliability and performance of your gas turbines.

Leading Manufacturers of Best Gas Turbines for Global Exports - Comparative Analysis of Gas Turbines for Different Industry Applications

| Manufacturer | Power Output (MW) | Efficiency (%) | Applications | Type |

|---|---|---|---|---|

| Manufacturer A | 100 | 38 | Power Generation | Simple Cycle |

| Manufacturer B | 150 | 42 | Industrial | Combined Cycle |

| Manufacturer C | 250 | 45 | Aviation | Aero-Derivative |

| Manufacturer D | 300 | 50 | Marine | Heavy-Duty |

| Manufacturer E | 400 | 53 | Power Generation & Oil & Gas | Industrial |

Export Trends and Market Demand for Gas Turbines Worldwide

The global demand for gas turbines has entered a significant growth phase, largely driven by the evolving energy landscape. With countries like Qatar leveraging extensive natural gas resources, such as the North Field, the market for gas turbines is booming. This region is witnessing increased electricity consumption, with forecasts indicating growth between 29% and 37% from 2020 to 2030. As nations aim to enhance their energy security and optimize their electricity generation capabilities, the necessity for efficient gas turbine technology becomes paramount.

Furthermore, the dynamics of liquefied natural gas (LNG) exports are reshaping market trends. The U.S. has positioned itself as a leading exporter of LNG, significantly altering the traditional energy supply chains. However, challenges such as the potential relaxation of sanctions on Russian natural gas pose new risks to this market. The ability of manufacturers to innovate and adapt their gas turbine technologies in response to these shifting demands will be crucial. As energy markets continue to transform, manufacturers must remain ahead of the curve to meet the increasing international appetite for gas turbines.

The Future of Gas Turbines: Sustainability and Efficiency Improvements

The gas turbine industry is undergoing a significant transformation driven by the need for sustainability and efficiency improvements. According to a recent report by ResearchAndMarkets, the global gas turbine market is expected to grow at a compound annual growth rate (CAGR) of 3.5% from 2023 to 2030, fueled by increasing demand for cleaner energy sources. Leading manufacturers are focusing on technology advancements, such as the development of more efficient combustion cycles and digital twin technology, which allows for better predictive maintenance, enhancing performance and reliability.

Sustainability initiatives are also influencing the design and operation of gas turbines. For instance, a study published by the International Energy Agency (IEA) indicates that integrating carbon capture and storage (CCS) with gas turbines can lead to significant reductions in carbon emissions, potentially capturing up to 90% of CO2 emissions from power generation. Furthermore, advancements in hybrid systems that combine gas turbines with renewable energy sources are paving the way for a more resilient and environmentally friendly energy landscape, highlighting the industry's commitment to a sustainable future.